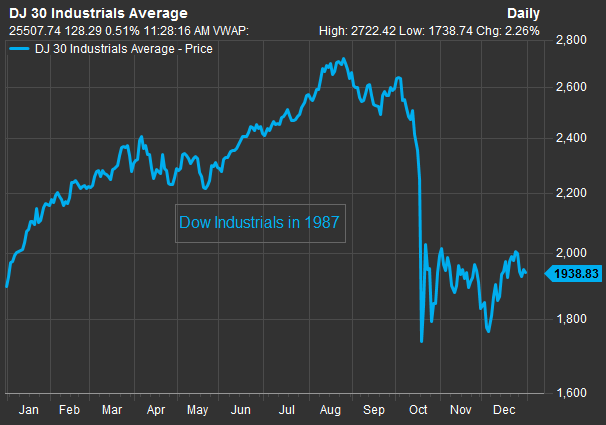

World Blog by humble servant.Market Talk. If the Dow dropped 22% like it did in 1987, it would mean a loss of more than 5,700 points today The Dow Jones Industrial Average plummeted 22.6 percent on Oct. 19, 1987, also known as "Black Monday," which amounted to 507.99 points at the time. A 22.6 percent plunge on the 30-stock Dow today would amount to a 5,735.76-point loss. For context, the biggest one-day point loss on the Dow took place on Feb. 5, when it closed down 1,175.21 points.

Picture taken October 19, 1987 shows a trader holding his head on the floor of the New York Stock Exchange when the Dow Jones dropped over 500 points, the largest decline in modern time, as panic selling swept Wall Street.

Friday marked the 31st anniversary of "Black Monday," by far the worst day ever in the U.S. stock market.

On that day — Oct. 19, 1987 — the Dow Jones Industrial Average plummeted 22.6 percent, or 507.99 points at the time. If that kind of plunge were to happen today, the point loss would be far worse.

A 22.6 percent plunge on the 30-stock Dow today would amount to a 5,735.76-point loss. For context, the biggest one-day point loss on the Dow took place on Feb. 5, when it closed down 1,175.21 points. But that was less than 5 percent.

Source: FactSet

Black Monday took place amid a combination of narrow market leadership, a collapse in the U.S. dollar and volatile swings in equities throughout the 1987 summer even as the economy ran hot that year. Other crashes have occurred since then, including the so-called Flash Crash of 2010.

Today, very few market experts expect a crash as the U.S. economy, along with corporate earnings, are growing at a solid pace. Safeguards and regulation have also been implemented to protect against such sharp drops.

But JC Parets, founder of All Star Charts, says a U.S. market crash is quite possible as equities slug through a tough October.

"The ingredients for a market crash are absolutely starting to appear," Parets said in a blog post Thursday. There is "very limited upside to buying stocks, other than for counter-trend trades, but unlimited downside potential."

"People underestimate the power of a leverage unwind and forced selling," he added. "Now, does it have to be a crash? No. We can trade in a range for a while."

The S&P 500 and Dow are down 4.2 percent and 3.4 percent, respectively, in October. If the S&P 500 closes lower for the month, it would snap a six-month winning streak. The Dow is on pace to post its first monthly loss in four months.

Comments

Post a Comment