World blog by humble servant. The greatest stock traders of all time...Question. .When they are bullish look out below...

I ask you:

1. Why do you consider Jesse Livermore the greatest investor of all time?. 2. Which are the main reasons?.

I look forward to hearing from you as soon as possible.

Sincerely,

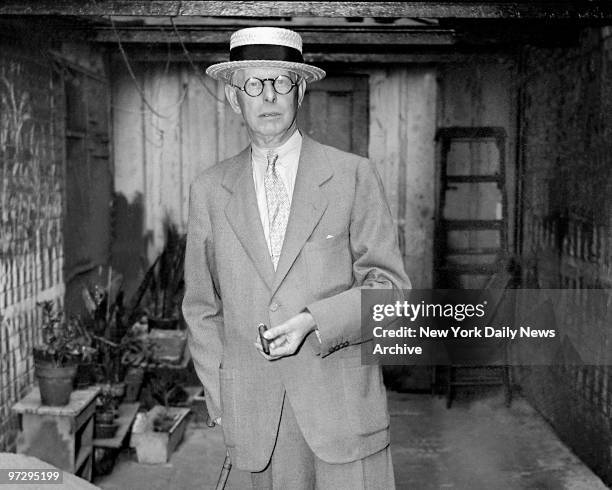

JEMV  ANSWER: Jesse Livermore (1877 – November 28, 1940), was a famed American investor and security analyst who was not always right. He was famous for making and losing several multi-million dollar fortunes and renowned for his short selling during the stock market crashes in 1907 and 1929. I would not necessarily say he was the all-time BEST trader in history. He has often been regarded as such. Jesse was very good and in the top ten. He could have been a bit more disciplined, but perhaps that applies to us all. Just as I may regard Jesse as one of the best, Jesse Livermore called James R. Keene (1838-1913) the “greatest of them all” with no hesitation. I, however, disagree. There is a difference between a perpetual bull and someone who can play the short-side. It takes a “nose” to be the latter.

Keene also made and lost fortunes many times over. He made his first fortune in California trading stock in mining companies. He rose to the top and even became the present of the San Francisco Stock Exchange. In 1876, he moved to New York City where the big money traded. He began investing heavily in racehorses. Then in 1884, see chart, Keene suffered tremendous losses in the Chicago grain market, which wiped him completely out. It was this loss that made me lose respect for him. He was betting on the long side, not the short-side. Keene simply bought and held. That is not a “trader” in my book.

Yet, James Keene began a remarkable comeback after he was hired by Wall Street investor William Havemeyer to manage a stock fund. His reputation grew and he was very good at market manipulation. He was then hired by J.P. Morgan and William Rockefeller to manage their funds. Keene knew how to “manipulate” markets to make money, but on the long-side. He attempts to actually manipulate the trend failed. That is not a trader to me. Yes, he had a talent for marketing something to make a profit. But anyone can get rich with a buy and hold strategy. If they are completely wiped out in a crash, that proves they do not have a “nose” for trading. They are just the standard buy and hold variety.

Therefore, what I will say is this with respect to WHY I rank Jesse above Keene. Jesse began trading at the young age of fourteen, and I understand this because I began at the age of thirteen. Jesse ran away from home because his father wanted him to be a farmer.

Jesse Livermore began his career by posting stock quotes at the Paine Webber brokerage in Boston. While working with the data, Jesse most likely saw the ebb and flow of the markets and the patterns within patterns. He would write down certain calculations he had about future market prices and then later check to see if he was correct. Some friend convinced him to put actual money on the market by making a bet at a bucket shop. By the age of fifteen, Jesse had made over $1,000 which was about an annual salary at that time. Because Jesse was a consistent winner, he was banned from most bucket shops from trading as they liked people who lost. This is probably why he left town and moved to New York City where he devoted all his energies to trading in the big markets.

Jesse did not always trade by his rules. He was famous for playing his gut feelings, selling Union Pacific Railroad short right before the 1906 San Francisco earthquake. The key to being a good trader, believe it or not, is never think about the money. If you think about the money, you freeze and cannot trade. I fully agree with Jesse’s comment after taking a loss:

“The loss of the money didn’t bother me. Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it.”

I have personally said many times that one should appreciate victories but cherish losses. It is ONLY from losses that we learn HOW to trade!Many people criticized Jesse’s famous trade going short at the top of Union Pacific. Many claimed it was just luck and judged him based on the fundamentals since he sold it before April 18th, 1906, famous San Francisco earthquake. With hindsight, the California earthquake of 1906 ranks as one of the most significant earthquakes of all time. However, the market peaked in January 1906 so it was not a tricky trade simply because the earthquake after he went short. I gathered the data to see IF I would have taken that trade personally. I must confess, I would have shorted that stock at the same time. Why? Let’s look closely and I will explain this as a trader who always had a good “nose” for trends myself.

As the story goes, one day in early 1906, Jesse stopped into a brokerage office where he was vacationing. Some said it was the Breakers Hotel Palm Beach in Florida which had opened up in 1896, and others said it was Atlantic City. Both were “the place” to go back then to get some sun. I would assume in January to March he would have gone to Florida and not New Jersey.

Livermore sold short Union Pacific, which was THE railroad giant and this one share accounted for around 50%+ of the trading volume back then. Jesse picked up a pad and wrote an order to sell a thousand shares of Union Pacific. The broker thought it was a mistake. Surely, he would not short a stock that always went up. After the first sell, Livermore began to press the market selling 2,000 shares short. He did these trades while on vacation. Jesse then cut his vacation short and quickly jumped on the train and returned to New York City. He added to his position again and the next day the San Andreas Fault ruptured at 5:13 a.m. on April 18, 1906.

The Dow Jones Railroad Index had just been split off when the index began in 1885, tracking 14 shared composed of 12 railroads and two industrials. Because of mergers, the following year saw the index composed of 12 shares of which 10 were railroads and two industrials. In 1889, the index was now changed to 20 shares composed of 18 railroads and two industrials. Because of the Industrial Revolution was just starting, the index was split in 1897 into the industrials and the railroads. But it was the railroad stocks that were dominant until the Panic of 1907.

The Panic of 1901 is not high on the list of memories but it was an important event which actually resulted in the peak in most railroad shares. The Panic was in part caused by a manipulation on the New York Stock Exchange as the struggle between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill fought for the financial control of the Northern Pacific Railway, which has been the major focus of Jay Cooke back in the day of the Panic of 1873. As the market crashed, a compromise was finally reached and the players agreed to form the Northern Securities Company. Then in 1904, the Supreme Court ruled against them that it was a monopoly in Northern Securities Co. v. United States, 193 U.S. 197 (1904).

The market peaked on January 22, 1906, closing at 138.36 on the Dow Railroad Index. The night before the earthquake the index closed at 132.66. After the news hit New York and the full extent of the damage to the railroad was known, the traders panicked and Livermore sold even more shares short. When the market fell for 10 days straight, closing at 121.89 on April 28, Jesse brought back all of the shares and racked up a profit of a quarter of a million dollars on one trade.

When we look objectively at the position of the market, it is clear what Jesse saw. The railroad stocks overall had really peaked during 1901 and were devastated during that Panic. Then there was the Rich Man’s Panic of 1903 where the final low unfolded. The Panic of 1903 reached its nadir in the Industrial Index on November 9, 1903, while the railroads bottomed nearly two months before on September 28, 1903. Industrials were just getting started and were seen as the more risky market to play.

John Gates (1855-1911), otherwise known as Bet-A-Million Gates because he was a huge gambler on horses, was considered one of the leaders of Wall Street. Gates was an industrialist who made his fortune by promoting of barbed wire. Gates went on a European business trip and vacation during 1902 and returned just in time for the 1903 panic. He was met at the dock by the press who wanted to hear his comments on the crash. He said:

“I am surprised at the condition of the stock market,” he told reporters who met his ship. “It is not natural. The causes are purely artificial, and they rest on a false basis. I do not believe there was ever a better time to invest in reasonable securities. I have come back stripped for the fray, and I am going down into Wall Street.”

Gates immediately formed a bull syndicate to buy up shares he believed were underpriced and of good value. Nevertheless, the market continued to trade against him during the spring of 1903 and then it resumed the decline during early summer.

The market really did not stabilize until late August when J.P. Morgan returned from his annual European art-collecting expedition. The mere presence of Morgan would calm markets. By October, the low was firmly in place with the railroad, but the industrials would have to wait for November before prices were on the way up.

The Rich Man’s Panic was the test before the rally into 1906. The little investor was out after 1901 and no longer trusted the market. Thus the recovery was in the hands of the investment bankers and this is why it became known as the “Rich Man’s Panic” rather similar to how the retail public fled the market after the crash of 2007-2009.

ANSWER: Jesse Livermore (1877 – November 28, 1940), was a famed American investor and security analyst who was not always right. He was famous for making and losing several multi-million dollar fortunes and renowned for his short selling during the stock market crashes in 1907 and 1929. I would not necessarily say he was the all-time BEST trader in history. He has often been regarded as such. Jesse was very good and in the top ten. He could have been a bit more disciplined, but perhaps that applies to us all. Just as I may regard Jesse as one of the best, Jesse Livermore called James R. Keene (1838-1913) the “greatest of them all” with no hesitation. I, however, disagree. There is a difference between a perpetual bull and someone who can play the short-side. It takes a “nose” to be the latter.

Keene also made and lost fortunes many times over. He made his first fortune in California trading stock in mining companies. He rose to the top and even became the present of the San Francisco Stock Exchange. In 1876, he moved to New York City where the big money traded. He began investing heavily in racehorses. Then in 1884, see chart, Keene suffered tremendous losses in the Chicago grain market, which wiped him completely out. It was this loss that made me lose respect for him. He was betting on the long side, not the short-side. Keene simply bought and held. That is not a “trader” in my book.

Yet, James Keene began a remarkable comeback after he was hired by Wall Street investor William Havemeyer to manage a stock fund. His reputation grew and he was very good at market manipulation. He was then hired by J.P. Morgan and William Rockefeller to manage their funds. Keene knew how to “manipulate” markets to make money, but on the long-side. He attempts to actually manipulate the trend failed. That is not a trader to me. Yes, he had a talent for marketing something to make a profit. But anyone can get rich with a buy and hold strategy. If they are completely wiped out in a crash, that proves they do not have a “nose” for trading. They are just the standard buy and hold variety.

Therefore, what I will say is this with respect to WHY I rank Jesse above Keene. Jesse began trading at the young age of fourteen, and I understand this because I began at the age of thirteen. Jesse ran away from home because his father wanted him to be a farmer.

Jesse Livermore began his career by posting stock quotes at the Paine Webber brokerage in Boston. While working with the data, Jesse most likely saw the ebb and flow of the markets and the patterns within patterns. He would write down certain calculations he had about future market prices and then later check to see if he was correct. Some friend convinced him to put actual money on the market by making a bet at a bucket shop. By the age of fifteen, Jesse had made over $1,000 which was about an annual salary at that time. Because Jesse was a consistent winner, he was banned from most bucket shops from trading as they liked people who lost. This is probably why he left town and moved to New York City where he devoted all his energies to trading in the big markets.

Jesse did not always trade by his rules. He was famous for playing his gut feelings, selling Union Pacific Railroad short right before the 1906 San Francisco earthquake. The key to being a good trader, believe it or not, is never think about the money. If you think about the money, you freeze and cannot trade. I fully agree with Jesse’s comment after taking a loss:

“The loss of the money didn’t bother me. Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it.”

I have personally said many times that one should appreciate victories but cherish losses. It is ONLY from losses that we learn HOW to trade!Many people criticized Jesse’s famous trade going short at the top of Union Pacific. Many claimed it was just luck and judged him based on the fundamentals since he sold it before April 18th, 1906, famous San Francisco earthquake. With hindsight, the California earthquake of 1906 ranks as one of the most significant earthquakes of all time. However, the market peaked in January 1906 so it was not a tricky trade simply because the earthquake after he went short. I gathered the data to see IF I would have taken that trade personally. I must confess, I would have shorted that stock at the same time. Why? Let’s look closely and I will explain this as a trader who always had a good “nose” for trends myself.

As the story goes, one day in early 1906, Jesse stopped into a brokerage office where he was vacationing. Some said it was the Breakers Hotel Palm Beach in Florida which had opened up in 1896, and others said it was Atlantic City. Both were “the place” to go back then to get some sun. I would assume in January to March he would have gone to Florida and not New Jersey.

Livermore sold short Union Pacific, which was THE railroad giant and this one share accounted for around 50%+ of the trading volume back then. Jesse picked up a pad and wrote an order to sell a thousand shares of Union Pacific. The broker thought it was a mistake. Surely, he would not short a stock that always went up. After the first sell, Livermore began to press the market selling 2,000 shares short. He did these trades while on vacation. Jesse then cut his vacation short and quickly jumped on the train and returned to New York City. He added to his position again and the next day the San Andreas Fault ruptured at 5:13 a.m. on April 18, 1906.

The Dow Jones Railroad Index had just been split off when the index began in 1885, tracking 14 shared composed of 12 railroads and two industrials. Because of mergers, the following year saw the index composed of 12 shares of which 10 were railroads and two industrials. In 1889, the index was now changed to 20 shares composed of 18 railroads and two industrials. Because of the Industrial Revolution was just starting, the index was split in 1897 into the industrials and the railroads. But it was the railroad stocks that were dominant until the Panic of 1907.

The Panic of 1901 is not high on the list of memories but it was an important event which actually resulted in the peak in most railroad shares. The Panic was in part caused by a manipulation on the New York Stock Exchange as the struggle between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill fought for the financial control of the Northern Pacific Railway, which has been the major focus of Jay Cooke back in the day of the Panic of 1873. As the market crashed, a compromise was finally reached and the players agreed to form the Northern Securities Company. Then in 1904, the Supreme Court ruled against them that it was a monopoly in Northern Securities Co. v. United States, 193 U.S. 197 (1904).

The market peaked on January 22, 1906, closing at 138.36 on the Dow Railroad Index. The night before the earthquake the index closed at 132.66. After the news hit New York and the full extent of the damage to the railroad was known, the traders panicked and Livermore sold even more shares short. When the market fell for 10 days straight, closing at 121.89 on April 28, Jesse brought back all of the shares and racked up a profit of a quarter of a million dollars on one trade.

When we look objectively at the position of the market, it is clear what Jesse saw. The railroad stocks overall had really peaked during 1901 and were devastated during that Panic. Then there was the Rich Man’s Panic of 1903 where the final low unfolded. The Panic of 1903 reached its nadir in the Industrial Index on November 9, 1903, while the railroads bottomed nearly two months before on September 28, 1903. Industrials were just getting started and were seen as the more risky market to play.

John Gates (1855-1911), otherwise known as Bet-A-Million Gates because he was a huge gambler on horses, was considered one of the leaders of Wall Street. Gates was an industrialist who made his fortune by promoting of barbed wire. Gates went on a European business trip and vacation during 1902 and returned just in time for the 1903 panic. He was met at the dock by the press who wanted to hear his comments on the crash. He said:

“I am surprised at the condition of the stock market,” he told reporters who met his ship. “It is not natural. The causes are purely artificial, and they rest on a false basis. I do not believe there was ever a better time to invest in reasonable securities. I have come back stripped for the fray, and I am going down into Wall Street.”

Gates immediately formed a bull syndicate to buy up shares he believed were underpriced and of good value. Nevertheless, the market continued to trade against him during the spring of 1903 and then it resumed the decline during early summer.

The market really did not stabilize until late August when J.P. Morgan returned from his annual European art-collecting expedition. The mere presence of Morgan would calm markets. By October, the low was firmly in place with the railroad, but the industrials would have to wait for November before prices were on the way up.

The Rich Man’s Panic was the test before the rally into 1906. The little investor was out after 1901 and no longer trusted the market. Thus the recovery was in the hands of the investment bankers and this is why it became known as the “Rich Man’s Panic” rather similar to how the retail public fled the market after the crash of 2007-2009. :max_bytes(150000):strip_icc()/HettyGreen-53101c42636a4604a562ac7a93f3857f.png) QUESTION: First I want to thank you for your guidance. You have helped me understand markets where I can see I was clueless before. You seem to be a contrarian. I take that is why you say the majority must always be wrong. Have you learned this to be the best way to look at the world?

Thank you for shining a light in these dark times.

GR

ANSWER: The greatest traders of all time have always been contrarians. They can see the patterns within patterns and how history repeats right before their eyes. Jesse Livermore (1877–1940) turned bullish in 1923. He could see the bull market coming. The Wall Street Journal accused him of turning bullish to influence the presidential elections. When they were proven wrong, the WSJ simply refused ever to quote Jesse ever again.

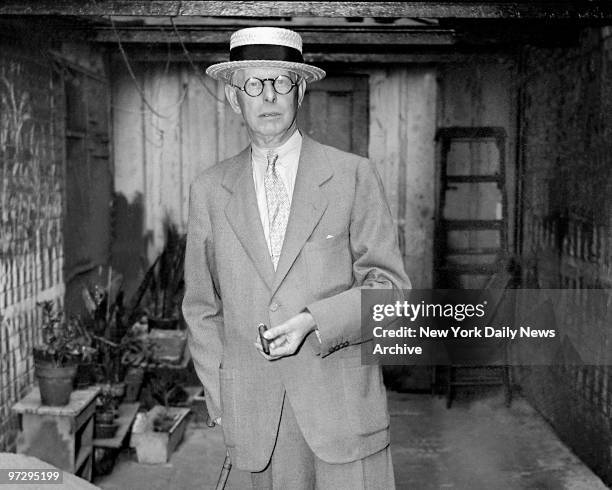

Hetty Green (1834-1916) was a woman in a man’s world. She became not just one of the wealthiest and most astute investors in American history, but she became the richest woman perhaps in the world. Hetty was known for her extreme frugality, which was exploited by her adversaries and made for good copy in the press. They dubbed her the “Witch of Wall Street” because she was such a good trader her wealth could outdo even the top ten Wall Street bankers in her day. She was in reality a woman during the era of robber barons when deals were done in dark oak wooden rooms filled with cigar smoke clouds that you would think it was going to rain.

Her reputation as the “Witch of Wall Street” was undeserved and today they would call it sexist. Hetty was the first female billionaire in modern terms who would be worth $10 billion+ in 2021. When she died in 1916, she was worth between $100-$125 million when a dollar was really worth something. She actually despised many of the titans of industry and finance of the day for their predatory ways and profligate spending. She actually sympathized more with the average hardworking citizen, yet she followed in her father’s Quaker footsteps.

Hetty Green was the woman of the Gilded Age. Few men could compete with her mentally. Hetty was abandoned at birth by her mother and she was viewed as a female by her father. Against this backdrop, Hetty set out as a child to prove she was of substance and had value. She followed the simple rules of her wealthy Quaker father, and always was extremely frugal. She would accompany him to the counting houses, storehouses, commodities, and stockbrokers. She observed trading from an early age and clearly saw the patterns within patterns.

While she inherited money, she understood trading. Perhaps her greatest trade was buying greenback bonds during the Civil War and into the panic of 1869. Some painted it as she never lost faith in America’s potential, but from a practical standpoint, she could see that the North was the industrial hub against the South which was agricultural. Others claim she just ignored the herd mentality and took advantage of financial panics and crises.

Indeed, during the civil war, Hatty bought federal bonds when the greenback would collapse against gold. In 1862, the greenback declined against gold until the end of the year when gold was trading at a 29% premium to the paper greenbacks. The following year, by the spring of 1863, the greenback collapsed to $152 against $100 in gold. After the Gettysburg victory, the greenback bounced back to $131 to $100 in gold. Then came 1864 when General Grant was making very little headway against General Lee. When it looked bleak in 1864, that is when the Greenback collapsed to its lowest point reaching during July 1864 briefly $258 greenbacks to $100 in gold.

The Greenback began to recover, dropping back to the $150 level. Congress limited the total issue of greenbacks to $450 million, which helped to support their value. Then the Panic of 1869 hit, and Greenbacks fell again to $162.50. Hetty made a fortune buying the Greenbacks at the lows. Then in December 1878, Congress made the Greenbacks on par with gold. What bonds in Greenbacks she was buying, she gained not just the interest but also about doubled her money on this trade alone.

Therefore, Hetty bought railroads, real estate, and bonds. She could smell blood in the streets, as they say in financial markets, and she was there to buy it up. Men mocked her, and women scoffed at her frugal ways. Nevertheless, she had thick skin, and because she would buy in the panics and win, they called her the “Witch of Wall Street.” Yet, she even supplied the loans that kept the city of New York itself from going bankrupt. Even when the markets panicked, Hetty looked at the trend and had a nose for seeing the market. She would be there lending money at 25%.

Hetty is said to have relished a challenge. When her aunt died and did not leave Hetty the fortune she expected, she filed a groundbreaking lawsuit that still resonates in law schools and courts. When her husband defied her and sank her money on his own risky interests, she threw him out and, marching down to Wall Street, quickly making up the loss. Her independence, outspokenness, and disdain for the upper crust earned her a reputation for the harshness that endured for decades. Yet, those who knew her admired her warmth, her wisdom, and her wit.

Her son, Edward Howland Robinson Green (1868-1936), was not so frugal and spent $3 million on coins and stamps. He was an avid collector and bought the famous sheet of 100 inverted airmail stamps in 1918, paying $20,000. The last example sold a few years ago and brought in $1.3 million. He also had bought all five of the known 1913 Liberty Head nickels, one sold for $3.2 million in 2014, and as many as seven of the rare 1838-O half dollars which will bring up to $750,000 today. He also held dozens of high-grade 1796 quarters which will bring $225,000+.

QUESTION: First I want to thank you for your guidance. You have helped me understand markets where I can see I was clueless before. You seem to be a contrarian. I take that is why you say the majority must always be wrong. Have you learned this to be the best way to look at the world?

Thank you for shining a light in these dark times.

GR

ANSWER: The greatest traders of all time have always been contrarians. They can see the patterns within patterns and how history repeats right before their eyes. Jesse Livermore (1877–1940) turned bullish in 1923. He could see the bull market coming. The Wall Street Journal accused him of turning bullish to influence the presidential elections. When they were proven wrong, the WSJ simply refused ever to quote Jesse ever again.

Hetty Green (1834-1916) was a woman in a man’s world. She became not just one of the wealthiest and most astute investors in American history, but she became the richest woman perhaps in the world. Hetty was known for her extreme frugality, which was exploited by her adversaries and made for good copy in the press. They dubbed her the “Witch of Wall Street” because she was such a good trader her wealth could outdo even the top ten Wall Street bankers in her day. She was in reality a woman during the era of robber barons when deals were done in dark oak wooden rooms filled with cigar smoke clouds that you would think it was going to rain.

Her reputation as the “Witch of Wall Street” was undeserved and today they would call it sexist. Hetty was the first female billionaire in modern terms who would be worth $10 billion+ in 2021. When she died in 1916, she was worth between $100-$125 million when a dollar was really worth something. She actually despised many of the titans of industry and finance of the day for their predatory ways and profligate spending. She actually sympathized more with the average hardworking citizen, yet she followed in her father’s Quaker footsteps.

Hetty Green was the woman of the Gilded Age. Few men could compete with her mentally. Hetty was abandoned at birth by her mother and she was viewed as a female by her father. Against this backdrop, Hetty set out as a child to prove she was of substance and had value. She followed the simple rules of her wealthy Quaker father, and always was extremely frugal. She would accompany him to the counting houses, storehouses, commodities, and stockbrokers. She observed trading from an early age and clearly saw the patterns within patterns.

While she inherited money, she understood trading. Perhaps her greatest trade was buying greenback bonds during the Civil War and into the panic of 1869. Some painted it as she never lost faith in America’s potential, but from a practical standpoint, she could see that the North was the industrial hub against the South which was agricultural. Others claim she just ignored the herd mentality and took advantage of financial panics and crises.

Indeed, during the civil war, Hatty bought federal bonds when the greenback would collapse against gold. In 1862, the greenback declined against gold until the end of the year when gold was trading at a 29% premium to the paper greenbacks. The following year, by the spring of 1863, the greenback collapsed to $152 against $100 in gold. After the Gettysburg victory, the greenback bounced back to $131 to $100 in gold. Then came 1864 when General Grant was making very little headway against General Lee. When it looked bleak in 1864, that is when the Greenback collapsed to its lowest point reaching during July 1864 briefly $258 greenbacks to $100 in gold.

The Greenback began to recover, dropping back to the $150 level. Congress limited the total issue of greenbacks to $450 million, which helped to support their value. Then the Panic of 1869 hit, and Greenbacks fell again to $162.50. Hetty made a fortune buying the Greenbacks at the lows. Then in December 1878, Congress made the Greenbacks on par with gold. What bonds in Greenbacks she was buying, she gained not just the interest but also about doubled her money on this trade alone.

Therefore, Hetty bought railroads, real estate, and bonds. She could smell blood in the streets, as they say in financial markets, and she was there to buy it up. Men mocked her, and women scoffed at her frugal ways. Nevertheless, she had thick skin, and because she would buy in the panics and win, they called her the “Witch of Wall Street.” Yet, she even supplied the loans that kept the city of New York itself from going bankrupt. Even when the markets panicked, Hetty looked at the trend and had a nose for seeing the market. She would be there lending money at 25%.

Hetty is said to have relished a challenge. When her aunt died and did not leave Hetty the fortune she expected, she filed a groundbreaking lawsuit that still resonates in law schools and courts. When her husband defied her and sank her money on his own risky interests, she threw him out and, marching down to Wall Street, quickly making up the loss. Her independence, outspokenness, and disdain for the upper crust earned her a reputation for the harshness that endured for decades. Yet, those who knew her admired her warmth, her wisdom, and her wit.

Her son, Edward Howland Robinson Green (1868-1936), was not so frugal and spent $3 million on coins and stamps. He was an avid collector and bought the famous sheet of 100 inverted airmail stamps in 1918, paying $20,000. The last example sold a few years ago and brought in $1.3 million. He also had bought all five of the known 1913 Liberty Head nickels, one sold for $3.2 million in 2014, and as many as seven of the rare 1838-O half dollars which will bring up to $750,000 today. He also held dozens of high-grade 1796 quarters which will bring $225,000+.

ANSWER: Jesse Livermore (1877 – November 28, 1940), was a famed American investor and security analyst who was not always right. He was famous for making and losing several multi-million dollar fortunes and renowned for his short selling during the stock market crashes in 1907 and 1929. I would not necessarily say he was the all-time BEST trader in history. He has often been regarded as such. Jesse was very good and in the top ten. He could have been a bit more disciplined, but perhaps that applies to us all. Just as I may regard Jesse as one of the best, Jesse Livermore called James R. Keene (1838-1913) the “greatest of them all” with no hesitation. I, however, disagree. There is a difference between a perpetual bull and someone who can play the short-side. It takes a “nose” to be the latter.

Keene also made and lost fortunes many times over. He made his first fortune in California trading stock in mining companies. He rose to the top and even became the present of the San Francisco Stock Exchange. In 1876, he moved to New York City where the big money traded. He began investing heavily in racehorses. Then in 1884, see chart, Keene suffered tremendous losses in the Chicago grain market, which wiped him completely out. It was this loss that made me lose respect for him. He was betting on the long side, not the short-side. Keene simply bought and held. That is not a “trader” in my book.

Yet, James Keene began a remarkable comeback after he was hired by Wall Street investor William Havemeyer to manage a stock fund. His reputation grew and he was very good at market manipulation. He was then hired by J.P. Morgan and William Rockefeller to manage their funds. Keene knew how to “manipulate” markets to make money, but on the long-side. He attempts to actually manipulate the trend failed. That is not a trader to me. Yes, he had a talent for marketing something to make a profit. But anyone can get rich with a buy and hold strategy. If they are completely wiped out in a crash, that proves they do not have a “nose” for trading. They are just the standard buy and hold variety.

Therefore, what I will say is this with respect to WHY I rank Jesse above Keene. Jesse began trading at the young age of fourteen, and I understand this because I began at the age of thirteen. Jesse ran away from home because his father wanted him to be a farmer.

Jesse Livermore began his career by posting stock quotes at the Paine Webber brokerage in Boston. While working with the data, Jesse most likely saw the ebb and flow of the markets and the patterns within patterns. He would write down certain calculations he had about future market prices and then later check to see if he was correct. Some friend convinced him to put actual money on the market by making a bet at a bucket shop. By the age of fifteen, Jesse had made over $1,000 which was about an annual salary at that time. Because Jesse was a consistent winner, he was banned from most bucket shops from trading as they liked people who lost. This is probably why he left town and moved to New York City where he devoted all his energies to trading in the big markets.

Jesse did not always trade by his rules. He was famous for playing his gut feelings, selling Union Pacific Railroad short right before the 1906 San Francisco earthquake. The key to being a good trader, believe it or not, is never think about the money. If you think about the money, you freeze and cannot trade. I fully agree with Jesse’s comment after taking a loss:

“The loss of the money didn’t bother me. Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it.”

I have personally said many times that one should appreciate victories but cherish losses. It is ONLY from losses that we learn HOW to trade!Many people criticized Jesse’s famous trade going short at the top of Union Pacific. Many claimed it was just luck and judged him based on the fundamentals since he sold it before April 18th, 1906, famous San Francisco earthquake. With hindsight, the California earthquake of 1906 ranks as one of the most significant earthquakes of all time. However, the market peaked in January 1906 so it was not a tricky trade simply because the earthquake after he went short. I gathered the data to see IF I would have taken that trade personally. I must confess, I would have shorted that stock at the same time. Why? Let’s look closely and I will explain this as a trader who always had a good “nose” for trends myself.

As the story goes, one day in early 1906, Jesse stopped into a brokerage office where he was vacationing. Some said it was the Breakers Hotel Palm Beach in Florida which had opened up in 1896, and others said it was Atlantic City. Both were “the place” to go back then to get some sun. I would assume in January to March he would have gone to Florida and not New Jersey.

Livermore sold short Union Pacific, which was THE railroad giant and this one share accounted for around 50%+ of the trading volume back then. Jesse picked up a pad and wrote an order to sell a thousand shares of Union Pacific. The broker thought it was a mistake. Surely, he would not short a stock that always went up. After the first sell, Livermore began to press the market selling 2,000 shares short. He did these trades while on vacation. Jesse then cut his vacation short and quickly jumped on the train and returned to New York City. He added to his position again and the next day the San Andreas Fault ruptured at 5:13 a.m. on April 18, 1906.

The Dow Jones Railroad Index had just been split off when the index began in 1885, tracking 14 shared composed of 12 railroads and two industrials. Because of mergers, the following year saw the index composed of 12 shares of which 10 were railroads and two industrials. In 1889, the index was now changed to 20 shares composed of 18 railroads and two industrials. Because of the Industrial Revolution was just starting, the index was split in 1897 into the industrials and the railroads. But it was the railroad stocks that were dominant until the Panic of 1907.

The Panic of 1901 is not high on the list of memories but it was an important event which actually resulted in the peak in most railroad shares. The Panic was in part caused by a manipulation on the New York Stock Exchange as the struggle between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill fought for the financial control of the Northern Pacific Railway, which has been the major focus of Jay Cooke back in the day of the Panic of 1873. As the market crashed, a compromise was finally reached and the players agreed to form the Northern Securities Company. Then in 1904, the Supreme Court ruled against them that it was a monopoly in Northern Securities Co. v. United States, 193 U.S. 197 (1904).

The market peaked on January 22, 1906, closing at 138.36 on the Dow Railroad Index. The night before the earthquake the index closed at 132.66. After the news hit New York and the full extent of the damage to the railroad was known, the traders panicked and Livermore sold even more shares short. When the market fell for 10 days straight, closing at 121.89 on April 28, Jesse brought back all of the shares and racked up a profit of a quarter of a million dollars on one trade.

When we look objectively at the position of the market, it is clear what Jesse saw. The railroad stocks overall had really peaked during 1901 and were devastated during that Panic. Then there was the Rich Man’s Panic of 1903 where the final low unfolded. The Panic of 1903 reached its nadir in the Industrial Index on November 9, 1903, while the railroads bottomed nearly two months before on September 28, 1903. Industrials were just getting started and were seen as the more risky market to play.

John Gates (1855-1911), otherwise known as Bet-A-Million Gates because he was a huge gambler on horses, was considered one of the leaders of Wall Street. Gates was an industrialist who made his fortune by promoting of barbed wire. Gates went on a European business trip and vacation during 1902 and returned just in time for the 1903 panic. He was met at the dock by the press who wanted to hear his comments on the crash. He said:

“I am surprised at the condition of the stock market,” he told reporters who met his ship. “It is not natural. The causes are purely artificial, and they rest on a false basis. I do not believe there was ever a better time to invest in reasonable securities. I have come back stripped for the fray, and I am going down into Wall Street.”

Gates immediately formed a bull syndicate to buy up shares he believed were underpriced and of good value. Nevertheless, the market continued to trade against him during the spring of 1903 and then it resumed the decline during early summer.

The market really did not stabilize until late August when J.P. Morgan returned from his annual European art-collecting expedition. The mere presence of Morgan would calm markets. By October, the low was firmly in place with the railroad, but the industrials would have to wait for November before prices were on the way up.

The Rich Man’s Panic was the test before the rally into 1906. The little investor was out after 1901 and no longer trusted the market. Thus the recovery was in the hands of the investment bankers and this is why it became known as the “Rich Man’s Panic” rather similar to how the retail public fled the market after the crash of 2007-2009.

ANSWER: Jesse Livermore (1877 – November 28, 1940), was a famed American investor and security analyst who was not always right. He was famous for making and losing several multi-million dollar fortunes and renowned for his short selling during the stock market crashes in 1907 and 1929. I would not necessarily say he was the all-time BEST trader in history. He has often been regarded as such. Jesse was very good and in the top ten. He could have been a bit more disciplined, but perhaps that applies to us all. Just as I may regard Jesse as one of the best, Jesse Livermore called James R. Keene (1838-1913) the “greatest of them all” with no hesitation. I, however, disagree. There is a difference between a perpetual bull and someone who can play the short-side. It takes a “nose” to be the latter.

Keene also made and lost fortunes many times over. He made his first fortune in California trading stock in mining companies. He rose to the top and even became the present of the San Francisco Stock Exchange. In 1876, he moved to New York City where the big money traded. He began investing heavily in racehorses. Then in 1884, see chart, Keene suffered tremendous losses in the Chicago grain market, which wiped him completely out. It was this loss that made me lose respect for him. He was betting on the long side, not the short-side. Keene simply bought and held. That is not a “trader” in my book.

Yet, James Keene began a remarkable comeback after he was hired by Wall Street investor William Havemeyer to manage a stock fund. His reputation grew and he was very good at market manipulation. He was then hired by J.P. Morgan and William Rockefeller to manage their funds. Keene knew how to “manipulate” markets to make money, but on the long-side. He attempts to actually manipulate the trend failed. That is not a trader to me. Yes, he had a talent for marketing something to make a profit. But anyone can get rich with a buy and hold strategy. If they are completely wiped out in a crash, that proves they do not have a “nose” for trading. They are just the standard buy and hold variety.

Therefore, what I will say is this with respect to WHY I rank Jesse above Keene. Jesse began trading at the young age of fourteen, and I understand this because I began at the age of thirteen. Jesse ran away from home because his father wanted him to be a farmer.

Jesse Livermore began his career by posting stock quotes at the Paine Webber brokerage in Boston. While working with the data, Jesse most likely saw the ebb and flow of the markets and the patterns within patterns. He would write down certain calculations he had about future market prices and then later check to see if he was correct. Some friend convinced him to put actual money on the market by making a bet at a bucket shop. By the age of fifteen, Jesse had made over $1,000 which was about an annual salary at that time. Because Jesse was a consistent winner, he was banned from most bucket shops from trading as they liked people who lost. This is probably why he left town and moved to New York City where he devoted all his energies to trading in the big markets.

Jesse did not always trade by his rules. He was famous for playing his gut feelings, selling Union Pacific Railroad short right before the 1906 San Francisco earthquake. The key to being a good trader, believe it or not, is never think about the money. If you think about the money, you freeze and cannot trade. I fully agree with Jesse’s comment after taking a loss:

“The loss of the money didn’t bother me. Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it.”

I have personally said many times that one should appreciate victories but cherish losses. It is ONLY from losses that we learn HOW to trade!Many people criticized Jesse’s famous trade going short at the top of Union Pacific. Many claimed it was just luck and judged him based on the fundamentals since he sold it before April 18th, 1906, famous San Francisco earthquake. With hindsight, the California earthquake of 1906 ranks as one of the most significant earthquakes of all time. However, the market peaked in January 1906 so it was not a tricky trade simply because the earthquake after he went short. I gathered the data to see IF I would have taken that trade personally. I must confess, I would have shorted that stock at the same time. Why? Let’s look closely and I will explain this as a trader who always had a good “nose” for trends myself.

As the story goes, one day in early 1906, Jesse stopped into a brokerage office where he was vacationing. Some said it was the Breakers Hotel Palm Beach in Florida which had opened up in 1896, and others said it was Atlantic City. Both were “the place” to go back then to get some sun. I would assume in January to March he would have gone to Florida and not New Jersey.

Livermore sold short Union Pacific, which was THE railroad giant and this one share accounted for around 50%+ of the trading volume back then. Jesse picked up a pad and wrote an order to sell a thousand shares of Union Pacific. The broker thought it was a mistake. Surely, he would not short a stock that always went up. After the first sell, Livermore began to press the market selling 2,000 shares short. He did these trades while on vacation. Jesse then cut his vacation short and quickly jumped on the train and returned to New York City. He added to his position again and the next day the San Andreas Fault ruptured at 5:13 a.m. on April 18, 1906.

The Dow Jones Railroad Index had just been split off when the index began in 1885, tracking 14 shared composed of 12 railroads and two industrials. Because of mergers, the following year saw the index composed of 12 shares of which 10 were railroads and two industrials. In 1889, the index was now changed to 20 shares composed of 18 railroads and two industrials. Because of the Industrial Revolution was just starting, the index was split in 1897 into the industrials and the railroads. But it was the railroad stocks that were dominant until the Panic of 1907.

The Panic of 1901 is not high on the list of memories but it was an important event which actually resulted in the peak in most railroad shares. The Panic was in part caused by a manipulation on the New York Stock Exchange as the struggle between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill fought for the financial control of the Northern Pacific Railway, which has been the major focus of Jay Cooke back in the day of the Panic of 1873. As the market crashed, a compromise was finally reached and the players agreed to form the Northern Securities Company. Then in 1904, the Supreme Court ruled against them that it was a monopoly in Northern Securities Co. v. United States, 193 U.S. 197 (1904).

The market peaked on January 22, 1906, closing at 138.36 on the Dow Railroad Index. The night before the earthquake the index closed at 132.66. After the news hit New York and the full extent of the damage to the railroad was known, the traders panicked and Livermore sold even more shares short. When the market fell for 10 days straight, closing at 121.89 on April 28, Jesse brought back all of the shares and racked up a profit of a quarter of a million dollars on one trade.

When we look objectively at the position of the market, it is clear what Jesse saw. The railroad stocks overall had really peaked during 1901 and were devastated during that Panic. Then there was the Rich Man’s Panic of 1903 where the final low unfolded. The Panic of 1903 reached its nadir in the Industrial Index on November 9, 1903, while the railroads bottomed nearly two months before on September 28, 1903. Industrials were just getting started and were seen as the more risky market to play.

John Gates (1855-1911), otherwise known as Bet-A-Million Gates because he was a huge gambler on horses, was considered one of the leaders of Wall Street. Gates was an industrialist who made his fortune by promoting of barbed wire. Gates went on a European business trip and vacation during 1902 and returned just in time for the 1903 panic. He was met at the dock by the press who wanted to hear his comments on the crash. He said:

“I am surprised at the condition of the stock market,” he told reporters who met his ship. “It is not natural. The causes are purely artificial, and they rest on a false basis. I do not believe there was ever a better time to invest in reasonable securities. I have come back stripped for the fray, and I am going down into Wall Street.”

Gates immediately formed a bull syndicate to buy up shares he believed were underpriced and of good value. Nevertheless, the market continued to trade against him during the spring of 1903 and then it resumed the decline during early summer.

The market really did not stabilize until late August when J.P. Morgan returned from his annual European art-collecting expedition. The mere presence of Morgan would calm markets. By October, the low was firmly in place with the railroad, but the industrials would have to wait for November before prices were on the way up.

The Rich Man’s Panic was the test before the rally into 1906. The little investor was out after 1901 and no longer trusted the market. Thus the recovery was in the hands of the investment bankers and this is why it became known as the “Rich Man’s Panic” rather similar to how the retail public fled the market after the crash of 2007-2009. :max_bytes(150000):strip_icc()/HettyGreen-53101c42636a4604a562ac7a93f3857f.png) QUESTION: First I want to thank you for your guidance. You have helped me understand markets where I can see I was clueless before. You seem to be a contrarian. I take that is why you say the majority must always be wrong. Have you learned this to be the best way to look at the world?

Thank you for shining a light in these dark times.

GR

ANSWER: The greatest traders of all time have always been contrarians. They can see the patterns within patterns and how history repeats right before their eyes. Jesse Livermore (1877–1940) turned bullish in 1923. He could see the bull market coming. The Wall Street Journal accused him of turning bullish to influence the presidential elections. When they were proven wrong, the WSJ simply refused ever to quote Jesse ever again.

Hetty Green (1834-1916) was a woman in a man’s world. She became not just one of the wealthiest and most astute investors in American history, but she became the richest woman perhaps in the world. Hetty was known for her extreme frugality, which was exploited by her adversaries and made for good copy in the press. They dubbed her the “Witch of Wall Street” because she was such a good trader her wealth could outdo even the top ten Wall Street bankers in her day. She was in reality a woman during the era of robber barons when deals were done in dark oak wooden rooms filled with cigar smoke clouds that you would think it was going to rain.

Her reputation as the “Witch of Wall Street” was undeserved and today they would call it sexist. Hetty was the first female billionaire in modern terms who would be worth $10 billion+ in 2021. When she died in 1916, she was worth between $100-$125 million when a dollar was really worth something. She actually despised many of the titans of industry and finance of the day for their predatory ways and profligate spending. She actually sympathized more with the average hardworking citizen, yet she followed in her father’s Quaker footsteps.

Hetty Green was the woman of the Gilded Age. Few men could compete with her mentally. Hetty was abandoned at birth by her mother and she was viewed as a female by her father. Against this backdrop, Hetty set out as a child to prove she was of substance and had value. She followed the simple rules of her wealthy Quaker father, and always was extremely frugal. She would accompany him to the counting houses, storehouses, commodities, and stockbrokers. She observed trading from an early age and clearly saw the patterns within patterns.

While she inherited money, she understood trading. Perhaps her greatest trade was buying greenback bonds during the Civil War and into the panic of 1869. Some painted it as she never lost faith in America’s potential, but from a practical standpoint, she could see that the North was the industrial hub against the South which was agricultural. Others claim she just ignored the herd mentality and took advantage of financial panics and crises.

Indeed, during the civil war, Hatty bought federal bonds when the greenback would collapse against gold. In 1862, the greenback declined against gold until the end of the year when gold was trading at a 29% premium to the paper greenbacks. The following year, by the spring of 1863, the greenback collapsed to $152 against $100 in gold. After the Gettysburg victory, the greenback bounced back to $131 to $100 in gold. Then came 1864 when General Grant was making very little headway against General Lee. When it looked bleak in 1864, that is when the Greenback collapsed to its lowest point reaching during July 1864 briefly $258 greenbacks to $100 in gold.

The Greenback began to recover, dropping back to the $150 level. Congress limited the total issue of greenbacks to $450 million, which helped to support their value. Then the Panic of 1869 hit, and Greenbacks fell again to $162.50. Hetty made a fortune buying the Greenbacks at the lows. Then in December 1878, Congress made the Greenbacks on par with gold. What bonds in Greenbacks she was buying, she gained not just the interest but also about doubled her money on this trade alone.

Therefore, Hetty bought railroads, real estate, and bonds. She could smell blood in the streets, as they say in financial markets, and she was there to buy it up. Men mocked her, and women scoffed at her frugal ways. Nevertheless, she had thick skin, and because she would buy in the panics and win, they called her the “Witch of Wall Street.” Yet, she even supplied the loans that kept the city of New York itself from going bankrupt. Even when the markets panicked, Hetty looked at the trend and had a nose for seeing the market. She would be there lending money at 25%.

Hetty is said to have relished a challenge. When her aunt died and did not leave Hetty the fortune she expected, she filed a groundbreaking lawsuit that still resonates in law schools and courts. When her husband defied her and sank her money on his own risky interests, she threw him out and, marching down to Wall Street, quickly making up the loss. Her independence, outspokenness, and disdain for the upper crust earned her a reputation for the harshness that endured for decades. Yet, those who knew her admired her warmth, her wisdom, and her wit.

Her son, Edward Howland Robinson Green (1868-1936), was not so frugal and spent $3 million on coins and stamps. He was an avid collector and bought the famous sheet of 100 inverted airmail stamps in 1918, paying $20,000. The last example sold a few years ago and brought in $1.3 million. He also had bought all five of the known 1913 Liberty Head nickels, one sold for $3.2 million in 2014, and as many as seven of the rare 1838-O half dollars which will bring up to $750,000 today. He also held dozens of high-grade 1796 quarters which will bring $225,000+.

QUESTION: First I want to thank you for your guidance. You have helped me understand markets where I can see I was clueless before. You seem to be a contrarian. I take that is why you say the majority must always be wrong. Have you learned this to be the best way to look at the world?

Thank you for shining a light in these dark times.

GR

ANSWER: The greatest traders of all time have always been contrarians. They can see the patterns within patterns and how history repeats right before their eyes. Jesse Livermore (1877–1940) turned bullish in 1923. He could see the bull market coming. The Wall Street Journal accused him of turning bullish to influence the presidential elections. When they were proven wrong, the WSJ simply refused ever to quote Jesse ever again.

Hetty Green (1834-1916) was a woman in a man’s world. She became not just one of the wealthiest and most astute investors in American history, but she became the richest woman perhaps in the world. Hetty was known for her extreme frugality, which was exploited by her adversaries and made for good copy in the press. They dubbed her the “Witch of Wall Street” because she was such a good trader her wealth could outdo even the top ten Wall Street bankers in her day. She was in reality a woman during the era of robber barons when deals were done in dark oak wooden rooms filled with cigar smoke clouds that you would think it was going to rain.

Her reputation as the “Witch of Wall Street” was undeserved and today they would call it sexist. Hetty was the first female billionaire in modern terms who would be worth $10 billion+ in 2021. When she died in 1916, she was worth between $100-$125 million when a dollar was really worth something. She actually despised many of the titans of industry and finance of the day for their predatory ways and profligate spending. She actually sympathized more with the average hardworking citizen, yet she followed in her father’s Quaker footsteps.

Hetty Green was the woman of the Gilded Age. Few men could compete with her mentally. Hetty was abandoned at birth by her mother and she was viewed as a female by her father. Against this backdrop, Hetty set out as a child to prove she was of substance and had value. She followed the simple rules of her wealthy Quaker father, and always was extremely frugal. She would accompany him to the counting houses, storehouses, commodities, and stockbrokers. She observed trading from an early age and clearly saw the patterns within patterns.

While she inherited money, she understood trading. Perhaps her greatest trade was buying greenback bonds during the Civil War and into the panic of 1869. Some painted it as she never lost faith in America’s potential, but from a practical standpoint, she could see that the North was the industrial hub against the South which was agricultural. Others claim she just ignored the herd mentality and took advantage of financial panics and crises.

Indeed, during the civil war, Hatty bought federal bonds when the greenback would collapse against gold. In 1862, the greenback declined against gold until the end of the year when gold was trading at a 29% premium to the paper greenbacks. The following year, by the spring of 1863, the greenback collapsed to $152 against $100 in gold. After the Gettysburg victory, the greenback bounced back to $131 to $100 in gold. Then came 1864 when General Grant was making very little headway against General Lee. When it looked bleak in 1864, that is when the Greenback collapsed to its lowest point reaching during July 1864 briefly $258 greenbacks to $100 in gold.

The Greenback began to recover, dropping back to the $150 level. Congress limited the total issue of greenbacks to $450 million, which helped to support their value. Then the Panic of 1869 hit, and Greenbacks fell again to $162.50. Hetty made a fortune buying the Greenbacks at the lows. Then in December 1878, Congress made the Greenbacks on par with gold. What bonds in Greenbacks she was buying, she gained not just the interest but also about doubled her money on this trade alone.

Therefore, Hetty bought railroads, real estate, and bonds. She could smell blood in the streets, as they say in financial markets, and she was there to buy it up. Men mocked her, and women scoffed at her frugal ways. Nevertheless, she had thick skin, and because she would buy in the panics and win, they called her the “Witch of Wall Street.” Yet, she even supplied the loans that kept the city of New York itself from going bankrupt. Even when the markets panicked, Hetty looked at the trend and had a nose for seeing the market. She would be there lending money at 25%.

Hetty is said to have relished a challenge. When her aunt died and did not leave Hetty the fortune she expected, she filed a groundbreaking lawsuit that still resonates in law schools and courts. When her husband defied her and sank her money on his own risky interests, she threw him out and, marching down to Wall Street, quickly making up the loss. Her independence, outspokenness, and disdain for the upper crust earned her a reputation for the harshness that endured for decades. Yet, those who knew her admired her warmth, her wisdom, and her wit.

Her son, Edward Howland Robinson Green (1868-1936), was not so frugal and spent $3 million on coins and stamps. He was an avid collector and bought the famous sheet of 100 inverted airmail stamps in 1918, paying $20,000. The last example sold a few years ago and brought in $1.3 million. He also had bought all five of the known 1913 Liberty Head nickels, one sold for $3.2 million in 2014, and as many as seven of the rare 1838-O half dollars which will bring up to $750,000 today. He also held dozens of high-grade 1796 quarters which will bring $225,000+.

Comments

Post a Comment